Table Of Content

Second, if you are a client of a fee-only fiduciary financial advisor, reach out to them anytime you've been cold-called for money. Over the years, we have heard and learned to evaluate many different appeals for money both from illegal scam artists, legal financial sales pitches, and real financial predicaments. As fiduciaries, we are on your side to ensure that your goals are met. Perhaps the most frightening part of the story is that he was told that after he had the money in his bank account, a personal representative by the name of Norma Dixon would accompany him to the bank. This is exactly the same name used in the exact same scam in this report from over a year ago. Second, neither the IRS nor state taxes are required to be paid in order to get your prize money.

About the FTC

$10,000” McKinley Harris from Winston-Salem exclaimed in 2018. While the check appears to be real, it's actually a fake. Even if a bank teller says a check has “cleared,” the BBB warns, the check could be detected as a fake weeks later. "One thing you can be sure of is that you will be on the hook for any funds drawn against the amount," the BBB said. "Actually I thought he had been drinking," said Levise, 72, who is retired after jobs in the supermarket industry and as a personal assistant for a broker in real estate. She now enjoys freelance photography, especially taking photos at the waterfront at twilight at the "moment when the light meets the dark."

PCH’s Guide to Avoid and Protect Yourself Against Scammers

Rosenworcel pointed out last fall that there has been a rise in scammers trying to take advantage of the general trust that consumers have in the text messages that they're receiving. Participants paid a fee but didn’t get the promised prizes, according to the FTC. Many people paid the fee several times before realizing there was no prize. The consumers, including many seniors, had been falsely told they had won or were likely to win as much as $2 million, according to the FTC. But they first needed to pay a fee ranging from $9 to $139.99. Everyone, of course, would love to feel like a winner — and the scammers are betting that they can grab some quick cash off those big dreams.

Beware of Scam Calls

Already without more information, there are red flags. But far more people end up feeling disappointed and tricked by reading too much into PCH’s well-written “You may be a winner” headers on its correspondence. The truth is that people do win Publishers Clearing House prizes.

Or the imposter text from a bank might ask you to "verify your account immediately" by clicking on a link. Crooks pretend that they're from the bank or credit union and they're trying to stop fraud when they're really trying to steal your money. They might ask for a special code but don't hand it over to them. "It’s time we take steps to confront this latest wave of fraud and identify how mobile carriers can block these automated messages before they have the opportunity to cause any harm," Rosenworcel said in a statement. "Robotexts are the next generation of scams," according to a report called "Ringing In Our Fears" by the U.S. The scammers can even be bold enough to claim that they're a BBB-accredited business.

Scammers asking you to open new accounts to collect prize money

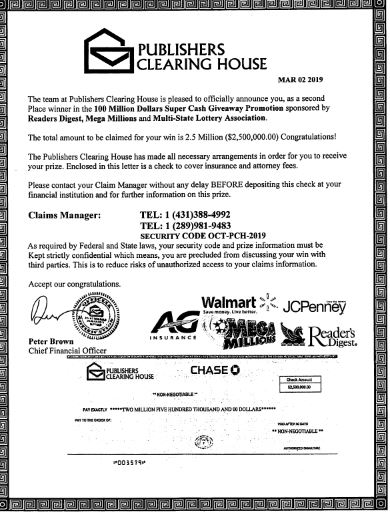

However, this was nothing more than an old scam. The reality here was that the company only notifies winners of their prizes by visiting them in person with their PCH Prize Patrol. They never award prizes over the phone, on social media, in email, or through the mail. The second is that the scammer will go as far as to send you a fake check. However, in the United States, sweepstakes sponsors will need to send the winner an affidavit prior to sending any check over $600. Thus, if you have not received an affidavit, there is a good chance you are being set up by a fraudster.

Scammer told Michigan woman to send $4,800 to claim fake Publishers Clearing House prize

The first is an attempt to retrieve personal information from a person, including some of the things mentioned earlier (social security number, address, date of birth, etc.). In essence, these people are looking to commit identity fraud. Therefore, you should never give out any of this information online, particularly to those who are claiming to be from PCH. It happened to me last week, the difference was thatthey were going to bring me a check for $14,500,000to my door. I guess fortunately for me, when i calledthe "876" number, which i later learned was Jamaica,no one answered. The man that called identified himself as John Miller, and gave me a "badge number." He insisted i write down everything he told me.

Tip 8: Contact PCH: Know the Company Conducting the Sweepstakes

Publishers Clearing House sweepstakes are legit, but not every win notification from them is. Many scammers misuse the PCH name, pretending to come from the company when they really come from someone hoping to steal your money or your identity. Some of those scams are sophisticated enough to make it difficult to tell if you've really won or not. Whether it's the grand prize or a smaller prize from any sweepstakes or business, you never have to pay upfront, no fees, not taxes, not shipping.

Recently we've been hearing reports that scammers are accessing and using the names of our real PCH employees in their criminal attempts to deceive you. Names you've come to know and recognize such as real members of our famous PCH Prize Patrol. To learn more about how to stay safe and protect yourself from fraudulent scammers, please click here. Remember, PCH never calls customers nor winners to tell them they have won. Recognizing the difference between legitimate sweepstakes and other types of offers that may not be legitimate will help you protect yourself and your family. This year, one of our clients called us because he had won a Publishers Clearing House prize of $18.5 million and needed to speak with me as soon as possible.

Because of "some specific tax laws," the client was told that $850K in federal taxes were immediately due to the IRS. His bank could handle that but he would need $58,580 in his checking account to pay state taxes. He was calling his financial advisor so we could help free up enough cash to transfer money to his checking account. Again, it’s important that we stress you did not hear from the real Publishers Clearing House.

Publishers Clearing House Refunds - Federal Trade Commission News

Publishers Clearing House Refunds.

Posted: Thu, 06 Jul 2023 15:21:08 GMT [source]

But that’s not the only way scammers get your money with this scam. Some will send you a realistic-looking fake check in the mail. You’re told that, to claim your prize, you need to deposit the check and send some of the money back for made-up expenses. But when the check you deposit bounces — even after it seemed to clear — you may be on the hook for the money you sent. We don't edit comments to remove objectionable content, so please ensure that your comment contains none of the above. The comments posted on this blog become part of the public domain.

Please click on this link for more information and stay protected. You can also follow these steps to report a scam directly to Publishers Clearing House. Those checks aren't legitimate, and you'll be left holding the bill. If you switched to a new annual plan within 60 days of your initial Aura annual subscription, you may still qualify for the Money Back Guarantee (based upon your initial annual plan purchase date).

No comments:

Post a Comment